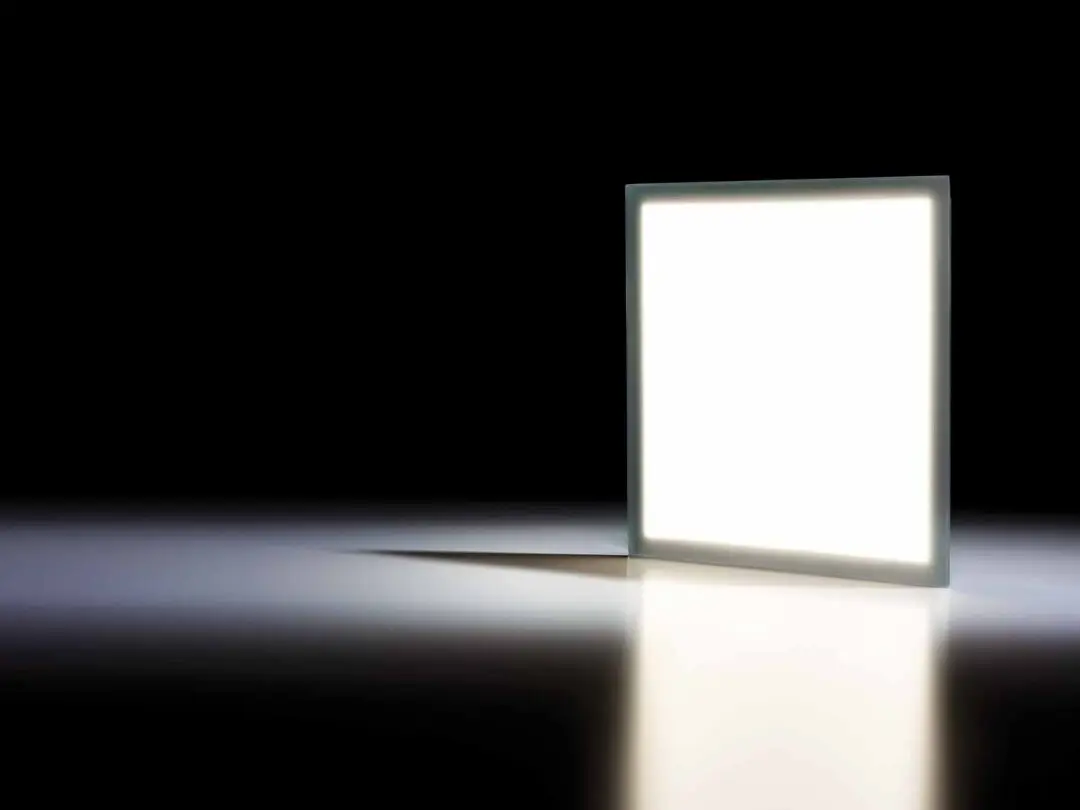

According to an OLED research report released by Research And Markets, the global organic light-emitting diode (OLED) market was valued at USD 19.45 billion in 2017 and is expected to reach USD 81.76 billion by 2026, growing 17.3% over the forecast period compound annual growth rate.

Some of the key factors influencing the market growth include increasing demand for energy-efficient and environmentally friendly lighting products, increasing adoption of electronic devices and gadgets, and increasing OLED applications in many end-use industries.

However, the market acceptance of OLED lighting fixtures is still low compared to LED fixtures, restraining the market growth.

Based on panel type, flexible panel OLEDs are expected to grow at a significant rate over the forecast period. Flexible displays are expected to drive the growth of the market owing to the increasing use of flexible display panels in smartphones and smart wearable devices and their potential use in other applications such as televisions, signage displays, and automotive.

Based on geography, the Asia-Pacific OLED market is expected to witness considerable growth owing to the presence of major players such as Samsung and LG Corporation. In addition, rapid industrialization has also contributed to improved economic conditions in countries in the region, enabling consumers to increase spending on luxury goods and high-end technology.

Some of the key players in the global Organic Light Emitting Diode (OLED) market are DLC Display Co., Limited, Panasonic, Cambridge Display Technology Limited, EI du Pont de Nemours and Company, Universal Display Corporation, Pioneer Corporation, Koninklijke Philips NV, Acuity Brands Lighting Inc., Novaled GmbH, Samsung Electronics Co., Ltd., LG Electronics Inc., SEIKO EPSON Corporation, Sony Corporation, Osram GmbH and FUTABA Corporation.

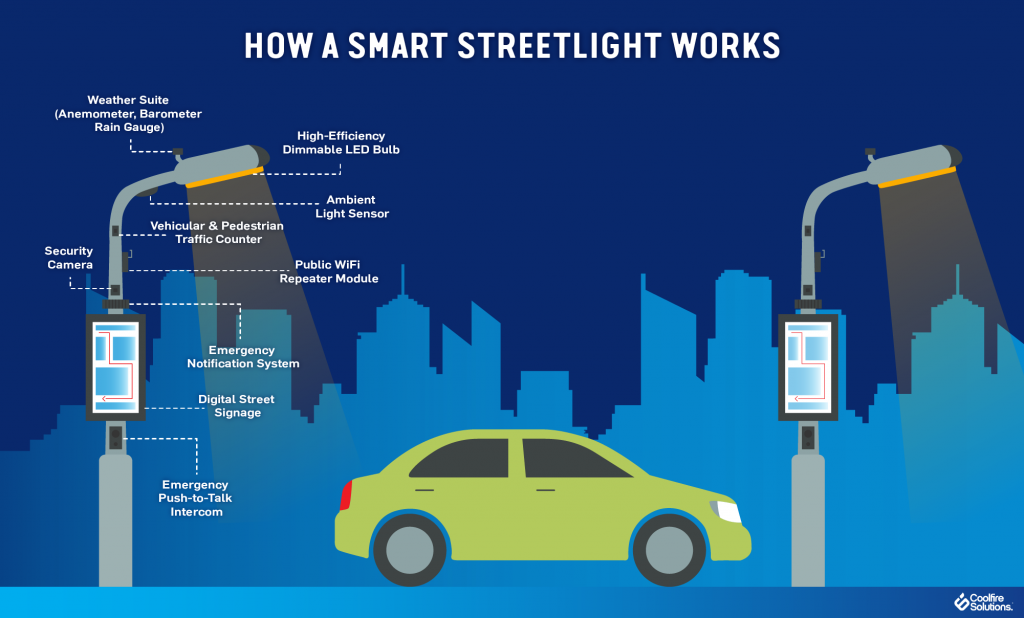

Smart Street Light Market Forecast

Technavio has released a new research report on the global connected (smart) street lighting market 2019-2023.

According to the research report, from 2019 to 2023, the smart street lighting market will grow at a compound annual growth rate of 28% to 675 million US dollars.

Big Mac is stronger

Wired connections will gain the highest share, with wireless connections growing faster

Wired connectivity technology has dominated the smart street lighting market for decades and is expected to dominate for some time to come. However, the advent of wireless connectivity technology is slowly reducing the need for and adoption of wired connections. This is primarily because wireless systems provide better monitoring of light performance and add value-added applications to existing setups. While the wireline business is expected to hold the largest market share, the gap is very small and the wireless connectivity business is expected to grow at a faster rate globally.

"Smart street lights use PLC, which was previously considered the safest communication module, superior to wireless communication modules such as Bluetooth. However, the upfront cost of PLC-based wired-connected street lights is higher than that of smart street light systems based on wireless communication modules. Therefore, wireless The adoption of street lights is expected to increase substantially over the next few years," said a senior research analyst at Technavio.

The emergence of smart cities

The concept of smart city has gained enormous popularity around the world. Smart cities include various IoT technologies that enhance communication between devices and improve their performance, while reducing costs and contributing to the efficient use of resources. In this context, smart street lights equipped with digital networks and embedded sensors help monitor urban traffic and air quality, as well as detect traffic congestion and track parking space availability. Smart street lights connected to cameras can reduce crime and accident risks, thereby improving road safety. Hence, the emergence of smart cities is expected to drive the growth of the global smart street lighting market size over the forecast period.

The major players in the smart street lighting market are Adesto Technologies Corp., Cisco Systems Inc. (Cisco), Itron Inc., Signify NV (Signify), etc. globally.

Smart Street Lights Will Achieve Fastest Application in Asia Pacific

The Asia Pacific region is expected to witness the fastest growth rate over the forecast period, mainly due to the increasing technological awareness and technology adoption by governments in the region. Continuous use of street lights at night increases electricity consumption and carbon emissions. As a result, governments in the region are adopting wireless smart street lighting systems to help city authorities reduce energy costs and carbon dioxide emissions. As such, the smart street lighting market in Asia Pacific is expected to grow substantially over the next five years.

Industrial Lighting Market Forecast

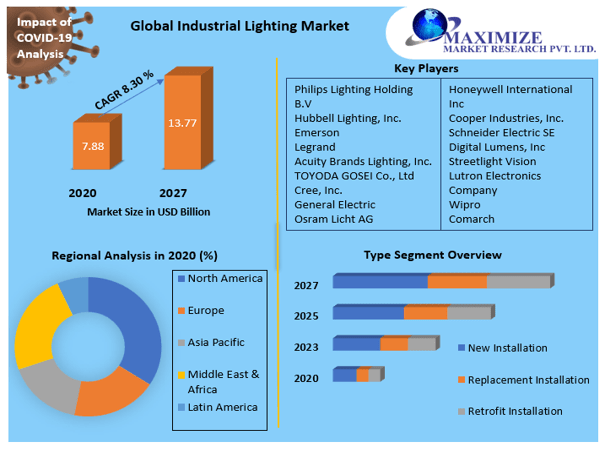

Research And Markets released the research report "Industrial Lighting Market: Global Growth, Trends and Forecast 2019-2024".

The industrial lighting market was valued at USD 4,025.6 million in 2018 and is expected to reach USD 5,179.2 million by 2024, growing at a CAGR of 4.5% during the forecast period 2019-2024.

Main Feature

● The availability of a wide range of lighting products at competitive prices and the growing demand for energy-efficient lighting systems in various industrial sectors are driving the market growth. For example, significant price reductions for LEDs in recent years have expanded the use of LED lighting products worldwide.

● In addition, favorable policies and regulations regarding traditional lighting and energy consumption in the US and China are expected to favor market growth.

● However, the initial cost required to integrate or replace lighting systems in manufacturing plants and production facilities is expensive, especially for small and medium industries.

Key Market Trends

● LEDs are characterized by long lifespan, high energy efficiency, low operation or maintenance costs, and faster and faster return on investment (ROI), ultimately driving their demand growth in the industrial lighting market.

● Recently, governments and utility companies have begun to offer incentives to help reduce industrial energy consumption, such as offering discounts to help offset the cost of LED retrofits or facility conversions to reduce the cost of energy usage.

● In addition, many companies have introduced and retrofitted LED lamps for indoor and outdoor applications, and they are slowly expanding into harsh environments.

● For example, Cree Inc. launched LED LXB series Linear High-Bay luminaires in October 2018, suitable for high ceilings, high ambient temperature and high-end spaces. The company reports that the launch of the LXB series is in line with continued demand for linear fixtures in new industrial buildings.

Asia Pacific will take a significant share

● With the majority of consumers in the urban areas of Asia Pacific increasingly shopping, leading online retailers are increasingly turning to smaller distribution centers in urban areas to complement larger out-of-town distribution centers. In South Korea, for example, a new government program called e-Logis Town is transforming old truck terminals and distribution centers into high-tech hubs, providing a significant opportunity for industrial lighting solution suppliers to enter the market.

● Governments in the region are promoting the use of energy-efficient lighting solutions, and the use of LED lighting is expected to increase significantly. For example, taking China as an example, from October 1, 2012, China will phase out incandescent lamps of 100 watts and above, and on October 1, 2016, the ban will be gradually expanded to 15 watts and above.

● From 2018 to 2020, India will invest nearly Rs 50,000 to build warehousing facilities nationwide. Over these three years, different categories of warehousing are expected to create around 20,000 jobs of various sizes and levels of specialization.

Competitive Landscape

The industrial lighting market is highly fragmented. Overall, the competition among existing competitors is fierce. Going forward, new innovation strategies of large and medium-sized enterprises are expected to drive market growth.

Some of the major developments in this field are:

● May 2019 - Legrand announced the launch of an ultra-secure wireless lighting control platform. The platform includes products such as dimmers, ceiling-mounted PIR occupancy sensors, digital photoelectric sensors, dimming wall switches, and 5-key scene switches.

● May 2019 - Acuity Brands announced to showcase new smart home and other residential lighting products at LIGHTFAIR International 2019. The flagship smart home product is the most advanced LED light in the Juno AI series. Juno AI fixtures feature advanced light controls and premium JBL speakers, all built-in and hidden, as well as offering Alexa voice service for a seamless, true smart home experience.

● January 2019 - GE added C-Start dimmer switches to connect to bulbs, one with built-in motion and ambient light sensors that add triggers to brighten or dim lights.

Stadium Lighting Market Forecast

According to Technavio's latest market research report, the global stadium lighting market is expected to grow at a CAGR of over 8% between 2019 and 2023.

Growing environmental concerns, including global warming and ozone depletion, are prompting governments in emerging and advanced economies to introduce stringent regulations to limit carbon dioxide emissions and several initiatives to increase the use of renewable energy. These initiatives have further boosted the demand for sustainable stadium lighting, including solar-powered stadium lighting. This has also prompted vendors in the global stadium lighting market to offer solar-powered stadium lighting, which is expected to drive market growth over the forecast period.

According to Technavio, the advent of smart stadium lighting control systems will positively impact the market and drive the market growth significantly over the forecast period.

Smart stadium lighting control system appears with smart stadiums

The advent of smart stadium lighting control systems is one of the key factors expected to trigger market growth over the forecast period.

The main driver for smart stadiums is the desire to provide better spectator experience and better operational efficiency. Smart stadiums can provide spectators with benefits such as internet connectivity, efficient crowd management, and additional information on ongoing games. Vendors in the market offer smart stadium lighting control systems to meet the needs of end users. Hence, the rising emergence of smart stadiums will have the potential to boost the growth of the stadium lighting market over the forecast period.

“With the increasing popularity of sporting events and the increasing construction of stadiums worldwide, the demand for stadium lighting will rise significantly in the coming years. Stadium authorities are increasingly focusing on installing high-quality lighting systems to enhance the viewing experience in stadiums. The lights also bring high-quality visuals to sports broadcasters, especially for slow-motion playback," said a senior research analyst at Technavio.

Global Stadium Lighting Market: Market Regional Analysis

This market research report segments the global stadium lighting market by bright source (HID, LED and others) and geographic region (Asia Pacific, Europe, North America, MEA and South America).

Asia Pacific led the market in 2018, followed by Europe, North America, MEA and South America. The market growth in Asia Pacific can be attributed to the construction of sports venues and the implementation of retrofit projects that seek to install efficient lighting to reduce energy consumption and maintenance costs.

Post time: May-17-2021